CDS Customs Overview

CDS Customs Overview

Attendees of this one-day course will learn the roles and responsibilities of each party involved in a customs declaration, the information that that needs to be supplied and submitted by each party and the differences between CHIEF and CDS.

CDS Overview Training Course

Based on our successful Customs declaration overview course the British Chambers of Commerce has updated the course to cover declarations made via CDS.

Attendees of this one-day course will learn the roles and responsibilities of each party involved in a customs declaration, the information that needs to be supplied and submitted by each party and the differences between CHIEF and CDS.

Is your company prepared for the upcoming deadlines?

After five years of preparation, The Customs Declaration Service (CDS) will be the long-term replacement for the current CHIEF (Customs Handling Imports and Export Freight) platform - replacing a system based on paperwork with a digital platform.

CHIEF closed its e-doors for import declarations on 30th September 2022. The final closure for export declarations will be on the 4th of June 2024.

Who is this training course made for?

This course is aimed at companies who are considering completing their own customs declarations, companies seeking to better understand their responsibilities, and companies that wish to ensure they are compliant with HMRC regulations.

Our training is instructor lead, delivered online with a remote package comprising e-learning modules. The is no previous knowledge required for this course.

If you work in one of the following departments of a trading business in the UK, this course will be beneficial to you:

Shipping

Logistics

Distribution

Finance

Export Administration

Export Sales Administration

Course outcome:

Attendees will have the knowledge to check a customs declaration for both import and export produced either by the company or a customs agent.

The course is essential for all staff involved in the customs declaration process and for those companies wishing to ensure their processes are HMRC compliant.

The following topics will be covered in this training course:

Introduction to trade

Business responsibilities

Export process

Import process

Valuation – explanation of the fiscal process of establishing the 'customs value' different from invoice value of goods and their application.

Classification – determining the use of commodity codes

How to use appropriate customs procedures

Customs procedures - export and import controls

Reliefs

Preferences

Customs Consultancy Bolt-on

As an additional service after the training, you can add a 1-day advisory service at a reduced price. This will give you access to one of our consultants for a high-level analysis of specific challenges your business faces when importing and exporting.

Delivery

Online and instructor-led, with an interactive Q&A session.

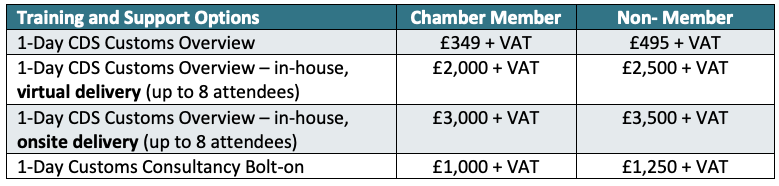

Training and Support Costs